Leading financial consultants in UAE

Book for Free Consultation

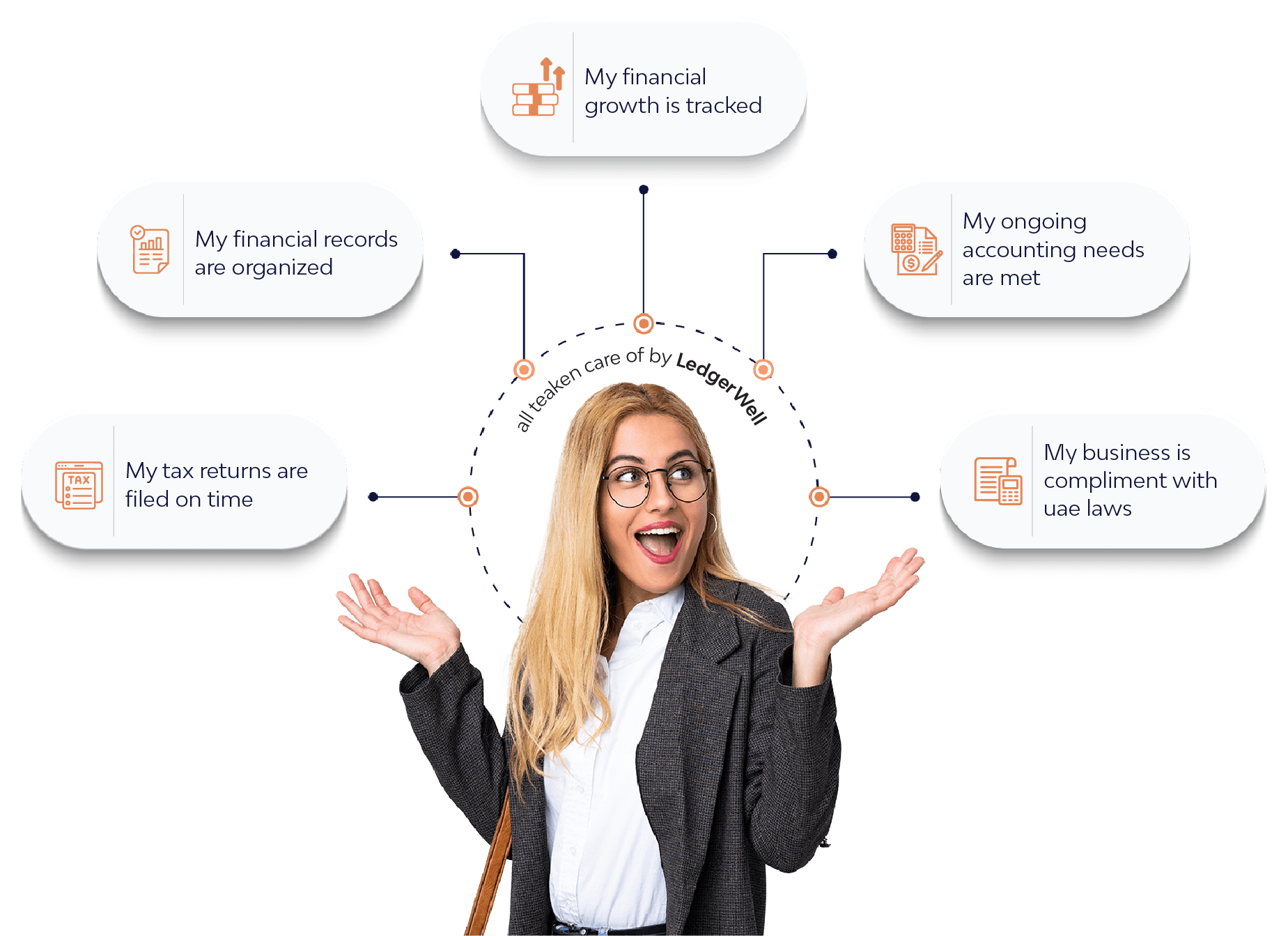

Stress free business life

Save your valuable time

Maximize Profit

Avoid the risk of penalties

Reduce unneccessary Expenses

Scaleup your business faster

Honest. Transparent. Trustworthy.

Personalized. Prioritized. Proactive.

Quality. Commitment. Growth.

Enhance trust and transparency with professional auditing services, identifying financial discrepancies and ensuring regulatory compliance for your business.

Streamline your finances with accurate accounting and bookkeeping services, ensuring compliance, efficiency, and clarity for smarter business decisions.

Unlock growth potential with tailored financial advisory solutions, guiding your business towards sustainable profitability and strategic financial success.

Start strong with hassle-free business setup services, from legal registrations to strategic planning, ensuring your business thrives from day one.

Ensure smooth international trade with precise customs auditing, identifying compliance gaps and optimizing processes for seamless import/export operations

Maximize savings and ensure full compliance with our expert taxation services, designed to minimize liabilities and optimize financial growth.

And your peace of mind is guaranteed with us